how are property taxes calculated in fl

Our Broward County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States. Florida tax rates by county are determined by county appraisers.

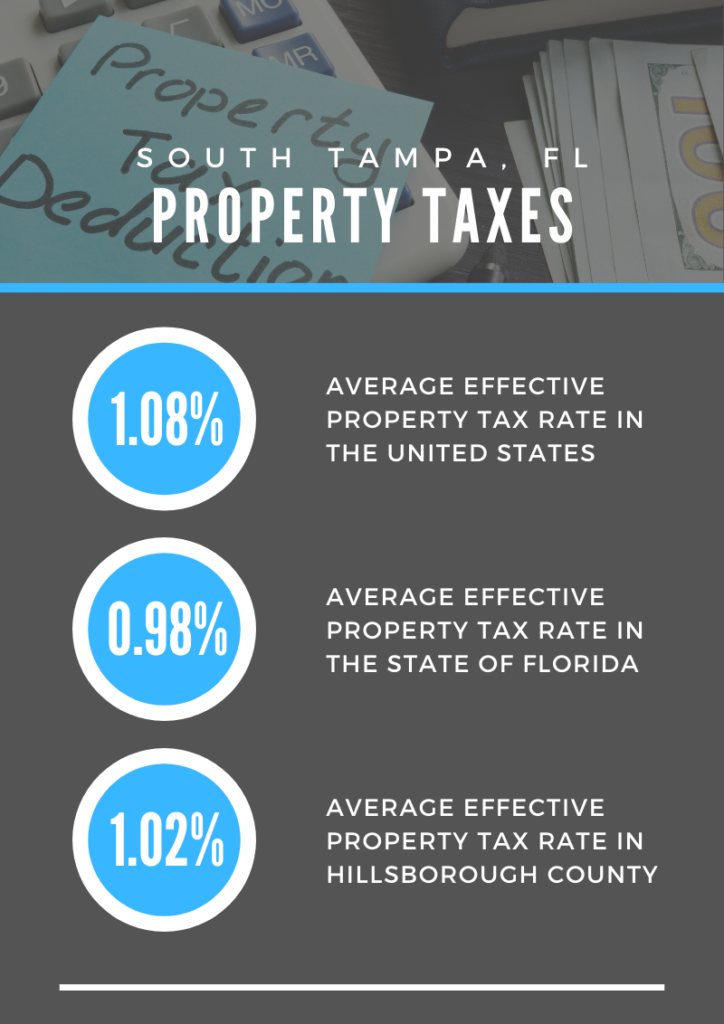

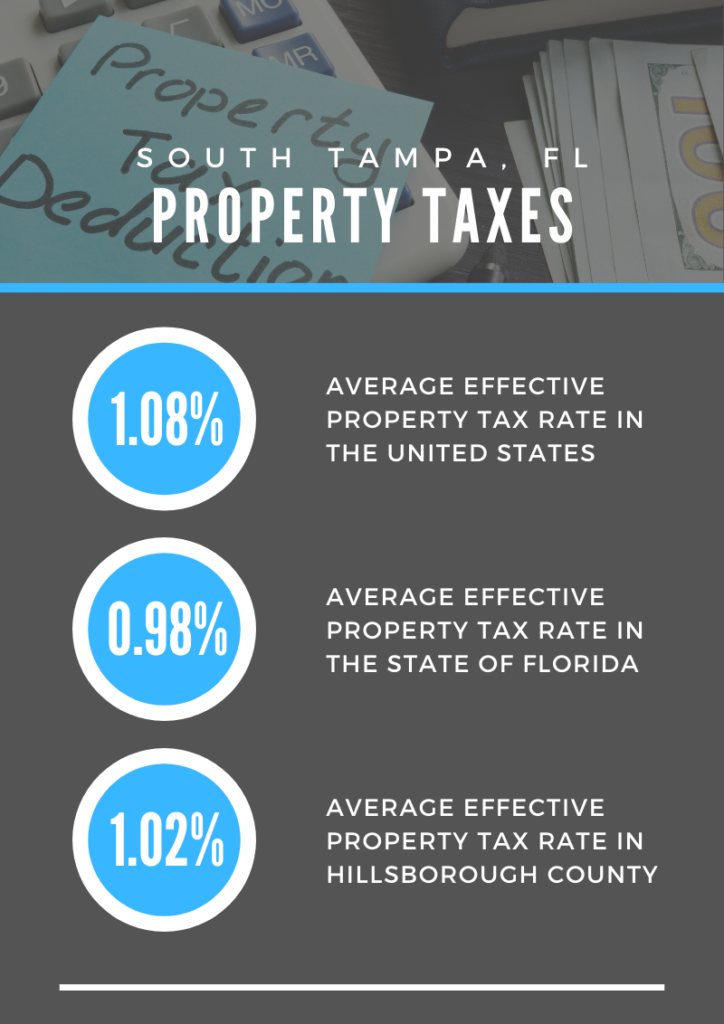

Property Taxes In South Tampa Fl Your South Tampa Home

Taxpayers may choose to pay next years 2019 tangibleproperty taxes quarterly by participating in.

. How to calculate property tax. Florida property taxes are computed on the taxable value To obtain the taxable value determine the assessed value of the home less eligible. This estimator is based on median property tax values in all of Floridas counties which can vary widely.

In this scenario if your propertys assessed value is. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys taxable value. How is Florida Property Tax Calculated.

RPT RPT rate x assessed value. HOW ARE FLORIDA PROPERTY TAXES CALCULATED. The following can be used to calculate the amount owed to municipalities in real property tax RPT.

There are a number of exemptions South Florida buyers may take advantage of such as the homestead tax exemption. 69 rows Whether you have a 10000 or 1000000 house you will owe real property taxes in Florida. This is an annual rate soassuming that tax rates remain consistentyou will pay 11250 every year.

Discover How To Calculate Property Taxes On A Sale Of A House In Florida for getting more useful information about real estate apartment mortgages near you. This allows a homeowner to reduce their homes assessed value by up to 50000 for tax purposes provided that the homeowner is a Florida resident and uses the property as a. Generally the property tax rate is expressed as a percentage per 1000 of assessed value.

The mill levy is determined by dividing 5 million by 400 million for a rate of 125 percent. For a more specific estimate find the calculator for your county. If your millage rate were dropped to 15 your tax bill would also decrease and you would only have to pay 3750 in property taxes every year.

Real property tax rates vary from state to state. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Calculate state and local sales and lodging taxes even for out of state properties.

Property tax calculator. How are Property Taxes Calculated in Florida. The value of a piece of.

You can calculate the real property tax based on the RPT rate of x determined value by clicking on this formula. Property Tax How To Calculate Local Considerations Florida Property Tax Consulting Property Tax Tax Payment Tax Consulting Ponte Vedra Real Estate Ponte Vedra Florida Pontevedra North City Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High The Neighbourhood Property Tax Assessment Daniel. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected.

Exemptions allow you to save up to thousands of dollars in property taxes. The median property tax on a 18240000 house is 191520 in the United States. The taxing jurisdiction school district municipality county special district develops and adopts a budget.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. The median property tax on a 18240000 house is 176928 in Florida. How To Calculate Property Taxes On A Sale Of A House In Florida - Real Estate Apartment Mortgages Informations.

When it comes to real estate property taxes are almost always based on the value of the land. Find the assessed value of the property being taxed. A local millage rate a dollar amount per 1000 of.

The percentage at which your property is taxed. Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes. Keep in mind that Metro Manilas tax rate is 2 and provinces tax rate is 1.

There are a number of factors that come into play when calculating property taxes from your propertys assessed value to the mill levy. In fact state and local governments use various methods to calculate your real property tax base. Property tax rate.

Property value is determined by a local tax assessor. Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property. 2100 of Assessed Home Value.

Add the value of the land and any improvements to determine the total value. Tax rates are calculated by local jurisdictions Determining tax rates. The assessed value estimates the reasonable market value for your home.

One factor in determining Florida property taxes is just value which is simply the market value of a property. Ad Avalara makes it easier to apply the right property rental tax on your customer bookings. Annual How Your Property Taxes Compare Based on an Assessed Home Value of 250000.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Multiply the propertys value by 45 to arrive at your tax bill. 2160 of Assessed Home Value.

Just value considers the price a property will sell for given current market conditions in an arms length transaction.

What Is Florida County Tangible Personal Property Tax

Disabled Veterans Property Tax Exemptions By State

Florida Property Taxes Explained

Property Taxes Calculating State Differences How To Pay

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Cape Coral Florida Condos For Sale Cape Coral

Real Estate Property Tax Constitutional Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Taxes Highlands County Tax Collector

Real Estate Taxes City Of Palm Coast Florida

Property Tax Prorations Case Escrow

Welcome To Montgomery County Texas

Florida Property Tax H R Block

Property Tax Comparison By State For Cross State Businesses

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes